Savings and Spending Accounts

The City of Chattanooga offers you two (2) different types of spending accounts for you to invest your funds on a tax-free basis to pay for qualified medical expenses.

The Flexible Spending Account (FSA) works similarly to a layaway account: you make an election at the beginning of the year and you have access to that entire amount on the first day of the plan year. You pay the money back in fixed amounts over the course of the year. Your enrollment in this type of plan is not tied to any particular medical plan; you can have an FSA even if you do not participate in the City's medical plan.

The Health Savings Account (HSA) in an individually owned account that has more flexibility in terms of what you can invest; you can choose when you contribute to the account and how much.

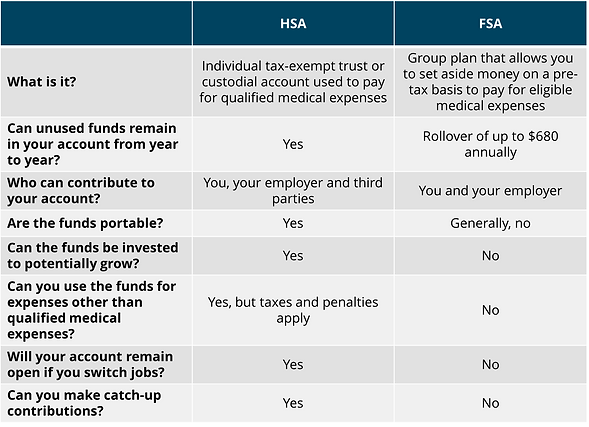

This table can help you distinguish between the two:

Contact Information

TASC (FSA)

Customer Service: 1-800-422-4661

HealthEquity (HSA)

Customer Service: 1-866-346-5800

Check out eligible expenses at www.irs.gov in Publications 502 and 503.

Flexible Spending Account (FSA) for Health Care and Dependent Daycare Expenses and Spending Accounts

This is an account that allows you to contribute pre-tax dollars on an annual basis to use for health care and dependent care expenses. You can participate in this benefit even if you are not enrolled in the health plan. Eligible expenses are based on IRS regulations, which include copays, coinsurance, and other medical expenses, including the cost of care of any eligible dependent care for working parents.

If you are enrolled in the HDHP, you are ineligible to participate in the health care FSA. However, you may elect to contribute to a dependent care FSA. By law, you must indicate your elections for FSA benefits annually.

Annual Contributions Limits (2026):

-

Health Care Flexible Spending Account: Maximum of $3,400

-

Dependent Care Spending Account: Maximum of $7,500

Note: Your FSA will cease the day you leave employment with the City. You may continue to use remaining funds up to the amount you have already contributed to your FSA; however, you will need to file a paper or online claim for reimbursement. You have only 30 days past your separation date to file “runout” claims. Runout funds can only be used for claims that were incurred or purchases you made prior to your separation date. Please contact TASC, the third-party administrator, at 1-800-422-4661 or visit online at www.tasconline.com for more information.

*Visit www.irs.gov for updated contribution limits and rollover amounts information.

Compare the Numbers...

Health Savings Account (HSA)

When you sign up for the High Deductible Health Plan (HDHP), you will have a Health Savings Account (HSA) in which you accumulate savings to pay for medical expenses that make up your deductible or are not covered by your insurance plan. HealthEquity is the HSA administrator. If you enroll, an account will be opened at HealthEquity and payroll contributions will be loaded to that account.

The Health Savings Account is an employee-owned account. This means the funds you contribute and receive are portable and rollover from year to year. Also, money remaining in your account can be saved for retirement.

Building Your Balance

2026 Annual Maximum Contributions to your HSA:

-

Employee - $4,400

-

Family - $8,750

-

Catch-up Contribution for those 55+ - $1,000